cash flow from assets formula

300 Cash Flow from Assets. This ratio indicates the cash a company can generate in relation to its size.

Deferred Tax Liabilities Meaning Example Causes And More Deferred Tax Accounting Education Financial Accounting

Now to calculate the cash return on assets ratio just put the values in the given formula in 321.

. Cash Flow from Investing Activities Example Apple Now let us have a look at a few more sophisticated cash flow statements for companies that are listed entities on NYSE. Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital. This is a positive cash flow.

So the cash return on assets ratio. Depreciation and Taxes are already specified. C a s h F l o w o n T o t a l A s s e t s C a s h F l o w f r o m O p e r a t i o n s A v e r a g e T o t a l A s s e t s.

Ad QuickBooks Financial Software. OCF EBIT Depreciation Taxes and since this includes EBIT we actually need to define this value first. Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital.

Cash flow from Investments formula Cash inflow from Sale of Land Cash outflow from PPE 30000 50000 -20000. Now that we have all the required values we can easily determine what Cash Flow from Assets would be. Total the amounts paid for all new fixed assets.

Take for example a company that is generating a cash flow of fifty thousand dollars from its operations and its assets are worth ten thousand dollars. Add up all the current assets. To calculate the net operating assets of a company you can use the following net operating assets formula.

Forecast your future cash position and regain your control on your business finances. Write down the items purchased and amount paid just below the assets sold list. Now for Company 50000 10000 5.

Rated the 1 Accounting Solution. Add the three amounts to determine the cash flow from assets. The discounted cash flow formula can help a business or investor understand the value of a company both.

24000 -10000 2000 16000. It means that the automaker generates a cash flow of 5 on every 1 of its assets. Discounted cash flow DCF is a valuation method that businesses use to estimate how much an asset is worth in the long term by using future cash flows.

Cash Flow Forecast Beginning Cash Projected Inflows - Projected Outflows Ending Cash. In other words DCF analysis looks at how much money investment will make over time. Cash returns on assets cash flow from operations Total assets.

Operating Cash Flow Operating Income Depreciation - Taxes Change In Working Capital. 500000 100000. CFI is an outflow of 20000.

The formula to calculate it is. Cash flow from operations. Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times.

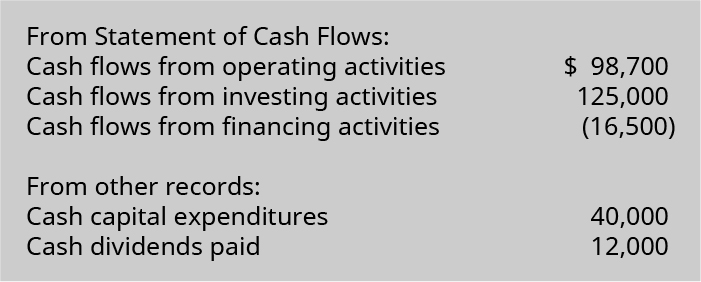

Two cash flow reports that every business owner should know are the statement of cash flows and the cash flow forecast. Required Investments in Operating Capital Year One Total Net Operating Capital. Johnson Paper Companys cash flow from assets for the previous year is 16000.

Cash Flow from Assets is also known as Free Cash Flow. Cash Flow on Total Assets Ratio Formula. Heres an easy cash flow formula.

Once they have these three numbers Johnson Paper Company can calculate their cash flow from assets. Cash flow represents your businesss free cash flow. CA 94063 1 415 650-1711.

Balance Sheet and Cash Flow into Google Sheets in no time. Operating Cash Flow Net Income - Changes in Assets Liability Non-Cash Expenses You are free to use this image on your website templates etc Please provide us with an attribution link How to Provide Attribution. Cash Flow to Assets Cash from Operations Total Assets.

Is the net cash flow from operating activities in the statement of cash flow. Cash Returns on Asset Ratio 5. DCF Cash Flow 1 r 1 Cash Flow 1 r 2 Cash Flow 1 r n Lets breakdown the formula as follows to understand it better.

Add all the fixed assets. Heres an easy cash flow formula. Comparing it with other automakers in the economy an investor can identify the firms growth prospects.

Cash used for investing in assets like securities bonds equipment or other fixed assets and cash generated from the sale of these types of assets. Free Cash Flow Sales Revenue Operating Costs Taxes Required Investments in Operating Capital where. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets.

Deduct the amount paid for new fixed assets from the cash receipts received from sold fixed assets. This is because the. This results in the following cash flow from assets calculation.

How do you calculate cash flow for fixed assets. Operating Cash Flow investment in fixed assets investment in net working capital. CFFA Method 1 OCF NCS - NWC so well first need to identify these values.

Identify the purchases of all fixed assets. What is the cash flow from assets for this firm based on CFFA method 1. Free Cash Flow Net Income Depreciation Amortization - Change In The Work Capital - Capital Expenditure.

Cash Flow From Assets Definition And Formula Bookstime

Use Information From The Statement Of Cash Flows To Prepare Ratios To Assess Liquidity And Solvency Principles Of Accounting Volume 1 Financial Accounting

Equity Ratio Definition Interpretations And Conclusions Equity Ratio Financial Ratio Equity

Impairment Cost Meaning Benefits Indicators And More In 2021 Money Management Advice Accounting And Finance Economics Lessons

The Sum Of The Years Digits Method Of Depreciation Accounting Education Learn Accounting Sum

Financial Freedom Workshops 4 Free Workshops Tickets Multiple Dates Eventbrite Financial Freedom Financial Free Workshops

Operating Cash Flow Formula Calculation With Examples

Long Term Debt Ratio Calculator Debt Ratio Debt Financial Management

Financial Statement Analysis Cheat Sheet By Mlboshoff Download Free From Cheatography C Financial Statement Analysis Financial Statement Accounting Student

Cash Flow From Assets Definition And Formula Bookstime

Capital Expenditure Formula Capital Expenditure Accounting And Finance Cash Flow Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow From Assets Definition And Formula Bookstime

Cash Flow Formula How To Calculate Cash Flow With Examples

Capital Gains Accounting And Finance Capital Gain Bookkeeping And Accounting

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)